We all dream of that perfect getaway – maybe it’s lounging on a tropical beach, exploring ancient European cities, or embarking on an adventure in the mountains. But let’s be honest: turning those travel dreams into reality takes more than just wishful thinking. It takes a solid savings plan and some creative money moves. Don’t worry though – I’m here to show you exactly how to save for your next vacation. If you’re ready to create a vacation savings plan, then let’s go!

This post may contain affiliate links and come at no cost to you. Thank you for supporting my small business!

Free Savings Tools

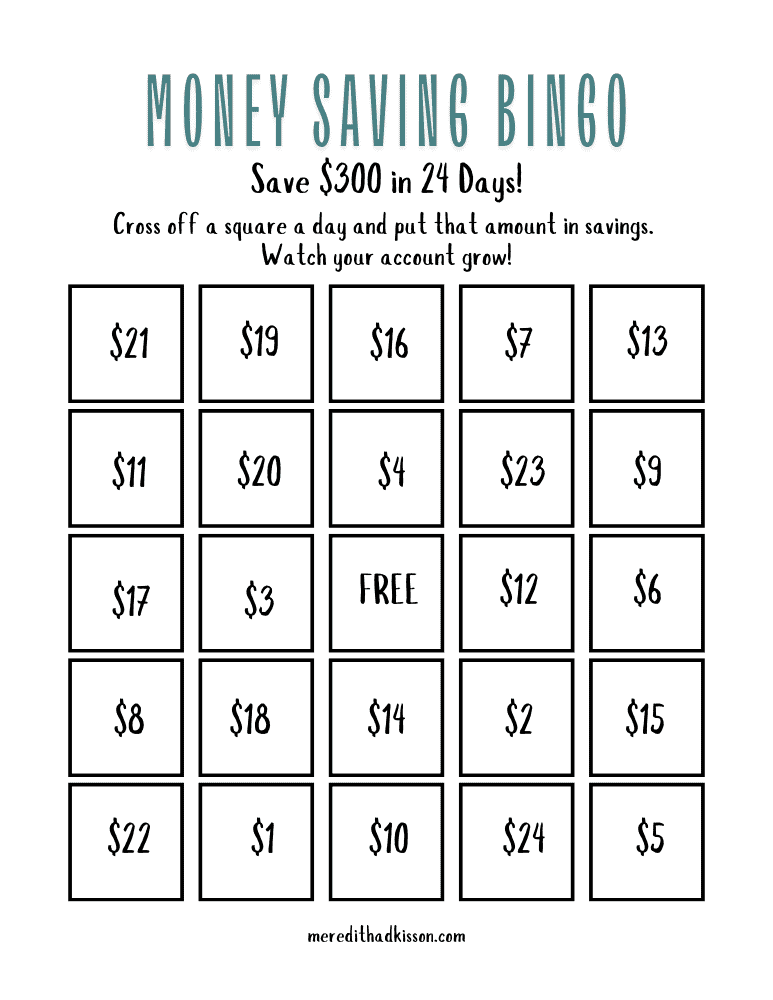

I’ve created a couple of free printable vacation savings plan tools. You’ll find a Savings Thermometer Tracker to keep your eye on the goal, as well as a Money Saving Bingo card to help you save some cash in a short amount of time. Click the images below to go straight to the downloads!

Free Vacation Money: Earn Cash Back on Gas and Dining with Upside!

If you haven’t heard of Upside, you’re missing out! I use Upside to get cashback on my gas purchases and at restaurants. I love the map feature, as it lets me easily search for gas stations around me and shows all the current pricing, so I can find the best price with the best cashback. Make sure you download the Upside app before your next road trip!

Use code AFF25 for a one-time $0.25/gallon bonus on your first receipt!

First Things First: Know Your Numbers

Before we dive into the strategies for your vacation savings plan, let’s get real about what you’re saving for. You need a realistic vacation budget. Take a few minutes to estimate how much your trip will cost. Include everything:

- Transportation (flights, rental cars, ride share, or train tickets)

- Places to stay (hotels, vacation rentals, or hostels)

- Daily expenses (meals, activities, and souvenirs)

- A small emergency fund (because life happens, even on vacation!)

If you love Excel Spreadsheets, here’s a fabulous free one from Kwantlen Polytechnic University. You can estimate your expenses and then use the same spreadsheet to track your actual vacation expenses.

Pro tip: Add about 15% to your initial estimate as a buffer. If you don’t end up needing it, great – you’ve got extra spending money or can set the extra money aside for your next trip!

Traditional Saving Strategies (That Actually Work!)

Automate, Automate, Automate

Here’s a secret that successful savers know: automation is your best friend. Set up a new account you can designate as your “vacation fund” and arrange automatic transfers for every payday. Even small amounts add up – $50 per week becomes $2,600 in a year! Think of it as paying your future self first. This is a key step of your vacation savings plan!

Saving For Your Next Trip with a Travel Savings Account

Having a separate account will make it easier to track and know exactly how much you need to save. Plus, getting your travel fund out of your checking account will help you avoid spending it and help you reach your savings goal faster! Just make sure you know the rules for your bank or credit union.

Some traditional savings accounts and high-yield savings accounts charge monthly if you don’t maintain a minimum balance. You don’t want to throw your hard-earned money away, so look for accounts that are free or have the lowest fees. Here’s a great article to break down the pros and cons of both high-yield and regular savings accounts, so you can choose the right vacation savings account.

Painless Vacation Savings

Small changes in your daily routine can make a big difference in saving money, and is one of the easiest steps that everyone can take in their vacation savings plan:

- Make your morning coffee at home (saving $4/day = $1,460/year)

- Pack lunch three times a week (saving $12/day = $1,872/year)

- Review your subscriptions (cutting one subscription at $15/mo = $180)

- Switch to store-brand potato chips (saving $4 a week = $208 a year)

- Go meatless two meals a week (saving $15 a week = $780 a year)

- Ditch the soda habit (saving $10 a week = $520 a year and a few pounds!)

- Do your own pedicure at home (saving $50 every 2 weeks = $1,300 a year)

If you made all those cuts in your spending, you’d have $5,618 to put toward your vacation!

See how cutting even the little purchases adds to big savings? It gets addictive. See what other little things you can cut out and set aside that money for travel!

Creative Money-Making Ideas to Increase Your Savings

Sometimes just saving money isn’t enough. Part of your vacation savings plan might be a side hustle. So, let’s think outside the box! Here are some ways to help your savings grow (that you might actually enjoy):

Digital Side Hustles

Turn your skills into cash without leaving home.

- Love writing? Try freelancing.

- Good with social media? Many small businesses need help managing their social media accounts.

- Enjoy teaching? There are always openings for virtual tutoring.

- Have homemade or used items to sell? List them on Etsy, eBay, or FB Marketplace.

- Got time to chill? Even online surveys during your Netflix time can add up to a little vacation money.

- Have any digital products or services you can sell? The digital marketplace is huge and even selling $2 digital downloads add up!

Local Gold Mines

Your community is full of opportunities to build up your savings:

- Pet sitting or dog walking can be a rewarding way to earn extra cash (plus, puppy cuddles!)

- Share your local knowledge as a weekend tour guide. Jessie on Journey has an awesome free cheat sheet to get you started on your own tour company!

- Transform your green thumb into green bills by selling at farmers’ markets or craft fairs. Not so green thumb? Sell handmade wares, art, soap, jewelry, etc. It’s a time-consuming but simple way to make a few hundred dollars on the side.

- Offer babysitting on weekends or holidays. You can set up a babysitting profile at Care.com or advertise on a local mom’s Facebook group.

- Schools are always in need of substitute teachers! If you have a flexible daytime schedule, this is a great way to give back to the community while earning some side cash.

- Donating plasma might sound painful but it comes with its benefits! Not only are you providing life-giving plasma for those in your community who desperately need it, but you can bring in a few extra hundred dollars a month! (Must pass a medical screening and meet certain qualifications as a donor.)

The Sharing Economy

You’d be surprised what people will pay to borrow:

- That parking spot you’re not using

- The tools and equipment gathering dust in your garage. Not everyone wants to buy a jackhammer, trailer, or pressure washer. If you’ve got one, rent it out on Facebook Marketplace or on the Rent My Equipment app.

- An office you can lease out for weekend or evening appointments.

- A car you don’t need all the time. Turo is surprisingly simple and safe for renting out your car

- Musical instruments stashed under your bed. Beginners often don’t want to pay for a brand-new one but would love to try out a quality instrument.

- Luxury pieces of clothing and accessories. Use Tulerie to lend out those gorgeous items just sitting in your closet. You’ll feel good about making a little money while justifying that pricey purchase in the first place.

- Your grounded watercraft. Got a boat, kayaks, or jet skis? Then you’ve got potential money just sitting there!

- That camper or pop-up parked out front. Many people would love to try a camper without committing to owning their own. You can easily list yours on AirBnB.

- Your $100k lockdown swimming pool. Now’s your chance to redeem some of that cash. Rent your pool on Swimply.

Smart Travel Savings Strategies

Timing Is Everything

Being flexible with your travel dates can save hundreds on travel. For example, traveling to Europe in February instead of July could cut your costs by 30% or more. Plus, you’ll deal with fewer crowds and get a more authentic experience.

Personal Note: I know this is tricky when you’ve got kids in school. You might feel tied down to the school calendar, but as a former teacher, I’m telling you to take the vacation if you can. Your child will learn so much more from the experience than from a week of sitting behind a desk.

While this is harder when your kids are in high school, most teachers I know are willing to work with your child if you communicate well and make a plan for getting schoolwork accomplished. What will your child remember when they’re an adult? That overseas vacation or that week of learning about aerobic respiration in Biology class?

Points and Miles Magic

Make your regular spending work harder for you:

- Use a travel rewards credit card for everyday purchases (but always pay it off monthly!) We rarely pay for hotels. Our Marriott credit cards have earned us countless free hotel stays and upgrades simply with everyday spending. I’ve also paid for 3 trips to Europe on points alone. If you’re already spending the money, you might as well make it work for you in the form of free travel!

- Join airline and hotel loyalty programs to earn status, and upgrades and accrue points toward free travel.

- Shop through airline or hotel shopping portals for things you’re spending money on anyway. You’ll earn some airline miles or points on purchases made at restaurants and online retailers.

For more info about scoring cheap flights, hotels and more and making that vacation savings work for you, check out this post:

Stay Motivated (The Secret Sauce)

Let’s face it – saving isn’t always exciting. But with the right motivation strategies, you can make the journey almost as fun as the destination itself! Here’s how to keep your vacation savings plan momentum going strong:

Visual Inspiration

- Create a vision board (digital or physical) with photos of your destination

- Make a phone wallpaper of your dream location

- Start a Pinterest board for activities and places you want to visit

- Keep a travel countdown app on your phone

- Download our vacation savings plan free savings thermometer and color it in as you progress.

Digital Motivation

- Use savings tracking apps, like Loot, that gamify your progress

- Follow travel photographers and bloggers from your chosen destination

- Share your vacation savings plan with your social media followers to create accountability and document your journey.

Make It Social

- Find a “savings buddy” and check in weekly on your progress

- Share your goals with friends and family (accountability works!)

- Join online communities of other travel savers

- Start a travel savings challenge with coworkers or friends

- Host a “destination-themed” potluck where everyone brings food from your target location

Reward Milestones

- Celebrate every 25% saved with a small-themed reward, like the travel gear you need for your trip.

- Watch movies or shows set in your destination

- Visit local restaurants featuring your destination’s cuisine

- Indulge in time to research and plan your dream trip at your favorite coffee shop

Create Tangible Reminders

- Use a clear jar for physical savings – watching it fill up is motivating!

- Make a paper chain and remove one link for each savings goal met

- Keep a travel journal documenting your preparation and planning

- Create a “motivation box” with travel brochures, currency from your destination, and inspiration

- Set up calendar reminders with encouraging messages to keep you focused on your goal

- Purchase a wall calendar with photographs of your destination

Track Your Progress and Celebrate!

- Break your vacation savings plan big goal into smaller weekly or monthly targets

- Create a dedicated vacation savings plan spreadsheet with colorful graphics

- Take monthly screenshots of your growing savings account

- Document your money-saving wins in a journal

- Share your creative money-saving ideas with others. If you can do it, others will want to, too!

Future Focus Activities

- Research one new thing about your destination each week

- Plan your ideal itinerary (even if it changes later)

- Make a bucket list for your destination

- Connect with locals or ex-pats from your destination online

- Start learning about the local culture and customs

Turn Saving into a Game

- Challenge yourself to “no-spend” days or weeks

- Challenge yourself to money-saving activities, like cooking at home every day for 30 days.

- Use our Money Saving BINGO card to save $300 easily!

- Compete with friends to see who can save the most in the shortest amount of time

Protect Your Hard-Earned Savings

Your vacation fund is sacred! No, you don’t need that TV that went on sale for Black Friday. Or that $500 digital coaching package that’s only available for the next 24 hours. Keep your travel savings safe by:

- Using a separate account to keep money out of sight, out of mind.

- Setting up account alerts to track progress

- Set up automatic transfers as soon as you get your paycheck

- Consider travel insurance for big trips- it may seem like an added expense but it could save you in the long run if you have to cancel your plans. This happened to people in my family and they were unfortunately out thousands of dollars. Life happens.

Vacation Savings Plan Go Time!

Remember, every journey begins with a single step. Start your vacation savings plan today:

- Calculate your target amount

- Set up that dedicated savings account

- Automate your savings

- Choose one or two (or a few!) creative money-making ideas to try

- Start researching your dream destination

The best part? The money skills you build while saving for your vacation will serve you well long after you return home. Plus, there’s something extra special about a vacation you’ve thoughtfully saved for – every moment feels sweeter when you know you’ve earned it!

Ready to start your vacation savings journey? Drop a comment below with your dream destination and the first step you’ve taken in your vacation savings plan. Let’s make those travel dreams happen together!

Happy saving and even happier traveling!